80-10-10 Financing: Whenever A couple of Mortgage loans Are better than One

The home markets will likely be an elaborate set at the best of times, with folks tend to trying to explain the alternatives to build anything simpler to create. In terms of mortgage loans, not, this new complex service could easily save you a fortune. Often, a couple mortgages are better than you to. When you find yourself taking out the next home loan may seem such as for example a bench-user friendly method for saving currency, an 80-10-ten mortgage is a terrific way to avoid the will cost you and you may downfalls for the an effective jumbo mortgage.

What is actually an 80-10-ten financing?

Also known as a combination mortgage, piggyback mortgage, or eighty-ten-10 loan, this kind of arrangement try structured while the one or two separate mortgages having just one deposit. When you find yourself 80-10-ten is among the most preferred proportion, you will need to keep in mind that these mortgage arrangement try in addition to the quantity on it. For example, someone will rating 75-15-10 financing to purchase condominiums or take benefit of straight down prices. Regardless of the proportion put, the original amount represents an important home loan, the center count is short for the smaller secondary home loan, while the third amount represents the first down payment.

How can i get a keen 80-10-10 financing?

So you’re able to make the most of an enthusiastic 80-10-ten mortgage, just be open to some additional difficulties. First of all, you must know that you are indeed taking out fully a couple separate funds. While this plan is similar to consolidating two separate mortgages lower than one umbrella, you nonetheless still need to try to get a couple private funds, often from separate lenders.

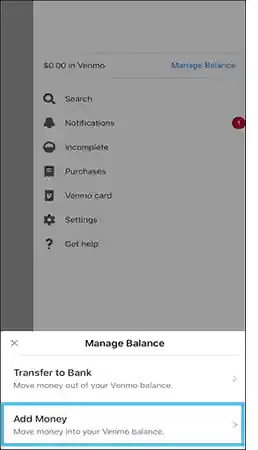

If you would like take out a combination financing, the first thing you’ll need to carry out are establish thereby applying having a first mortgage. As soon as your number 1 financial understands that need a keen 80-10-10 loan, you could potentially have them request referrals to own lenders just who may be interested in offering you a moment financial. Even though some loan providers concentrate on such plans, anybody else is unwilling to get involved. Within version of arrangement, the newest second home loan is property equity credit line (HELOC).

Benefits of playing with a mortgage broker getting a keen 80-10-ten financing

Obtaining one or two fund are tricky, that have several groups of economic data called for, one or two loan requests expected, as well as 2 closings to organize. A large financial company will likely be incredibly rewarding in this processes once the capable compare lenders and you can techniques the main points of one’s combination mortgage in one single step. Dealing with a large financial company opens up your up to a whole lot more alternatives once the agents happen to be writing on numerous lenders as an element of their typical procedure.

Drawbacks regarding an enthusiastic 80-10-ten mortgage

As previously mentioned, probably the greatest downside out of taking out a combination mortgage are the additional difficulty and you can work on it. As well as increasing upon programs and you will closings, additionally, it may be much more tough to re-finance the personal loan with no origination fee loan otherwise create security because of the unconventional characteristics of arrangement. Eg, refinancing the borrowed funds will require new consent from both first and you will second mortgage brokers. Given that HELOC interest rates is actually varying, they’re able to including increase throughout the years, making it harder to create guarantee when making appeal-just payments.

Masters out-of an enthusiastic 80-10-10 financing

Regardless of the a lot more issue and challenges, taking out a combo financial also offers lots of benefits over a great jumbo loan. If you choose to wade both financial channel, you will be able to steer without mortgage insurance, which is required when a loan amount is over 80 percent of one’s property value the house. This is exactly a primary reason why 80-10-ten funds have been popular over the years-consumers are able to take advantage of a beneficial loophole on financing guidelines.

When your second financing is actually a great HELOC and you have a credit score of 740 or more, a combo loan are cheaper than a normal financing which have Private Mortgage Insurance coverage (PMI) during the earliest 10 years because the HELOC was notice-only. While doing so, combination funds enable it to be borrowers to quit the newest rigid lending criteria related that have jumbo money. This may replace your possibility of improving mortgage rates of the with the additional home loan as a down payment enhance. If you think that a keen 80-10-10 mortgage is the proper services for you, talking to First Resource Believe Deeds is the perfect place to help you start.

Leave a Reply